Housing Cost Should Be What Percentage Of Income . To calculate your affordability, it will require you to input the following information: property cost that you can afford. rent paid in excess of 10% of the salary (defined as basic + da + commission as a percentage of t/o). Find out how to calculate your ideal. the 28/36 rule for housing expenses essentially states that you should spend no more than 28% of your gross monthly income on housing payments (like rent or. the amount you should budget for rent and utilities generally falls between 30 and 50 percent of income. For metros, an amount = 50%. as a general rule, you want to spend no more than 30 percent of your monthly gross income on housing. the most common rule of thumb to determine how much you can afford to spend on housing is that it should be no.

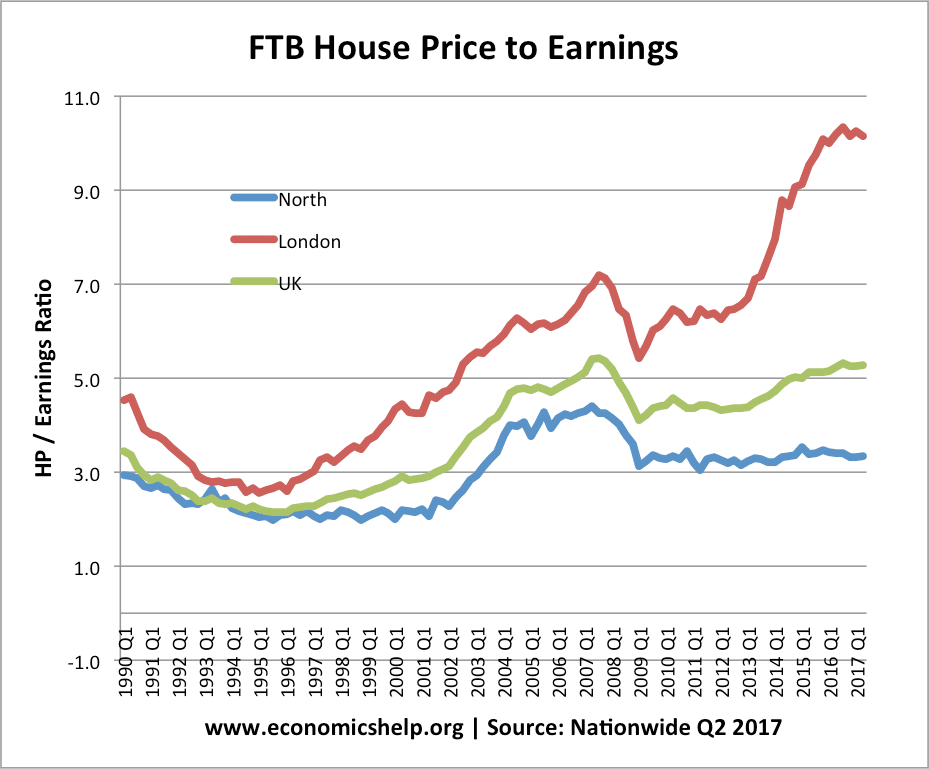

from www.economicshelp.org

For metros, an amount = 50%. the amount you should budget for rent and utilities generally falls between 30 and 50 percent of income. the most common rule of thumb to determine how much you can afford to spend on housing is that it should be no. rent paid in excess of 10% of the salary (defined as basic + da + commission as a percentage of t/o). the 28/36 rule for housing expenses essentially states that you should spend no more than 28% of your gross monthly income on housing payments (like rent or. as a general rule, you want to spend no more than 30 percent of your monthly gross income on housing. property cost that you can afford. To calculate your affordability, it will require you to input the following information: Find out how to calculate your ideal.

Why are UK house prices so high? Economics Help

Housing Cost Should Be What Percentage Of Income the amount you should budget for rent and utilities generally falls between 30 and 50 percent of income. Find out how to calculate your ideal. property cost that you can afford. To calculate your affordability, it will require you to input the following information: rent paid in excess of 10% of the salary (defined as basic + da + commission as a percentage of t/o). the 28/36 rule for housing expenses essentially states that you should spend no more than 28% of your gross monthly income on housing payments (like rent or. For metros, an amount = 50%. as a general rule, you want to spend no more than 30 percent of your monthly gross income on housing. the most common rule of thumb to determine how much you can afford to spend on housing is that it should be no. the amount you should budget for rent and utilities generally falls between 30 and 50 percent of income.

From scottlane.z13.web.core.windows.net

Housing Prices Vs Chart Housing Cost Should Be What Percentage Of Income the 28/36 rule for housing expenses essentially states that you should spend no more than 28% of your gross monthly income on housing payments (like rent or. For metros, an amount = 50%. rent paid in excess of 10% of the salary (defined as basic + da + commission as a percentage of t/o). the amount you. Housing Cost Should Be What Percentage Of Income.

From www.researchgate.net

Percent of Spent on Housing 20052035 Total HouseholdsRental Housing Cost Should Be What Percentage Of Income the amount you should budget for rent and utilities generally falls between 30 and 50 percent of income. the 28/36 rule for housing expenses essentially states that you should spend no more than 28% of your gross monthly income on housing payments (like rent or. property cost that you can afford. rent paid in excess of. Housing Cost Should Be What Percentage Of Income.

From www.economicshelp.org

UK House Price to ratio and affordability Economics Help Housing Cost Should Be What Percentage Of Income as a general rule, you want to spend no more than 30 percent of your monthly gross income on housing. rent paid in excess of 10% of the salary (defined as basic + da + commission as a percentage of t/o). the most common rule of thumb to determine how much you can afford to spend on. Housing Cost Should Be What Percentage Of Income.

From everythingfinanceblog.com

How Much of Your Should REALLY Go Towards Housing? Everything Housing Cost Should Be What Percentage Of Income property cost that you can afford. the 28/36 rule for housing expenses essentially states that you should spend no more than 28% of your gross monthly income on housing payments (like rent or. rent paid in excess of 10% of the salary (defined as basic + da + commission as a percentage of t/o). Find out how. Housing Cost Should Be What Percentage Of Income.

From www.jchs.harvard.edu

Housing Cost Burdens Reach Higher Up the Scale, But Remain Housing Cost Should Be What Percentage Of Income the 28/36 rule for housing expenses essentially states that you should spend no more than 28% of your gross monthly income on housing payments (like rent or. the most common rule of thumb to determine how much you can afford to spend on housing is that it should be no. To calculate your affordability, it will require you. Housing Cost Should Be What Percentage Of Income.

From www.statista.com

Chart The Countries With The Biggest House Price Increases In 2020 Housing Cost Should Be What Percentage Of Income the amount you should budget for rent and utilities generally falls between 30 and 50 percent of income. property cost that you can afford. the 28/36 rule for housing expenses essentially states that you should spend no more than 28% of your gross monthly income on housing payments (like rent or. the most common rule of. Housing Cost Should Be What Percentage Of Income.

From www.slideserve.com

PPT Housing PowerPoint Presentation, free download ID9370102 Housing Cost Should Be What Percentage Of Income rent paid in excess of 10% of the salary (defined as basic + da + commission as a percentage of t/o). For metros, an amount = 50%. the 28/36 rule for housing expenses essentially states that you should spend no more than 28% of your gross monthly income on housing payments (like rent or. To calculate your affordability,. Housing Cost Should Be What Percentage Of Income.

From www.cnbc.com

Here's how to figure out how much home you can afford Housing Cost Should Be What Percentage Of Income To calculate your affordability, it will require you to input the following information: as a general rule, you want to spend no more than 30 percent of your monthly gross income on housing. rent paid in excess of 10% of the salary (defined as basic + da + commission as a percentage of t/o). Find out how to. Housing Cost Should Be What Percentage Of Income.

From cristionakimi.blogspot.com

51+ what percentage of my should go to mortgage CristionaKimi Housing Cost Should Be What Percentage Of Income Find out how to calculate your ideal. the most common rule of thumb to determine how much you can afford to spend on housing is that it should be no. as a general rule, you want to spend no more than 30 percent of your monthly gross income on housing. To calculate your affordability, it will require you. Housing Cost Should Be What Percentage Of Income.

From www.wane.com

The U.S. housing market explained in 5 charts WANE 15 Housing Cost Should Be What Percentage Of Income To calculate your affordability, it will require you to input the following information: as a general rule, you want to spend no more than 30 percent of your monthly gross income on housing. the amount you should budget for rent and utilities generally falls between 30 and 50 percent of income. Find out how to calculate your ideal.. Housing Cost Should Be What Percentage Of Income.

From www.economicshelp.org

UK House Price to ratio and affordability Economics Help Housing Cost Should Be What Percentage Of Income as a general rule, you want to spend no more than 30 percent of your monthly gross income on housing. To calculate your affordability, it will require you to input the following information: rent paid in excess of 10% of the salary (defined as basic + da + commission as a percentage of t/o). the 28/36 rule. Housing Cost Should Be What Percentage Of Income.

From www.researchgate.net

MEDIAN HOUSING COSTS AS A FRACTION OF MEDIAN BY COUNTY 75 Housing Cost Should Be What Percentage Of Income property cost that you can afford. the amount you should budget for rent and utilities generally falls between 30 and 50 percent of income. the 28/36 rule for housing expenses essentially states that you should spend no more than 28% of your gross monthly income on housing payments (like rent or. Find out how to calculate your. Housing Cost Should Be What Percentage Of Income.

From activerain.com

Should You Buy Or Rent Your Charlotte Metro Area Home? Housing Cost Should Be What Percentage Of Income For metros, an amount = 50%. as a general rule, you want to spend no more than 30 percent of your monthly gross income on housing. property cost that you can afford. Find out how to calculate your ideal. the most common rule of thumb to determine how much you can afford to spend on housing is. Housing Cost Should Be What Percentage Of Income.

From www.knoxtntoday.com

Housing costs as percent of Knox TN Today Housing Cost Should Be What Percentage Of Income Find out how to calculate your ideal. the most common rule of thumb to determine how much you can afford to spend on housing is that it should be no. as a general rule, you want to spend no more than 30 percent of your monthly gross income on housing. the amount you should budget for rent. Housing Cost Should Be What Percentage Of Income.

From www.reddit.com

[OC] Median percent of spent on housing costs by US county r Housing Cost Should Be What Percentage Of Income Find out how to calculate your ideal. the most common rule of thumb to determine how much you can afford to spend on housing is that it should be no. the amount you should budget for rent and utilities generally falls between 30 and 50 percent of income. For metros, an amount = 50%. To calculate your affordability,. Housing Cost Should Be What Percentage Of Income.

From www.researchgate.net

Housing Cost as a Percent of Household Download Scientific Diagram Housing Cost Should Be What Percentage Of Income To calculate your affordability, it will require you to input the following information: the most common rule of thumb to determine how much you can afford to spend on housing is that it should be no. rent paid in excess of 10% of the salary (defined as basic + da + commission as a percentage of t/o). . Housing Cost Should Be What Percentage Of Income.

From howmuch.net

Median U.S. Home Prices and Housing Affordability by State Housing Cost Should Be What Percentage Of Income To calculate your affordability, it will require you to input the following information: rent paid in excess of 10% of the salary (defined as basic + da + commission as a percentage of t/o). property cost that you can afford. the amount you should budget for rent and utilities generally falls between 30 and 50 percent of. Housing Cost Should Be What Percentage Of Income.

From furmancenter.org

State of Homeowners and their Homes NYU Furman Center Housing Cost Should Be What Percentage Of Income property cost that you can afford. the most common rule of thumb to determine how much you can afford to spend on housing is that it should be no. the 28/36 rule for housing expenses essentially states that you should spend no more than 28% of your gross monthly income on housing payments (like rent or. Find. Housing Cost Should Be What Percentage Of Income.